Middle Class Tax Refund

We are not authorized to reissue payments for the MCTR program after May 31, 2024.

Overview

The Middle Class Tax Refund (MCTR) was a one-time payment issued to eligible recipients between October 2022 and January 2023, to provide relief to Californians.

Reminder to activate your debit card

If you received a Middle Class Tax Refund (MCTR) debit card and did not activate it, you were mailed an activation reminder letter that includes instructions on activating your debit card. For assistance with activation, replacement, lost, or stolen MCTR card, call 1-800-240-0223.

For questions or to activate your card, see below for contact information.

-

Receiving and using your debit card

Some taxpayers received their payment on a debit card. Refer to the How payments were issued section for information on how debit cards were distributed.

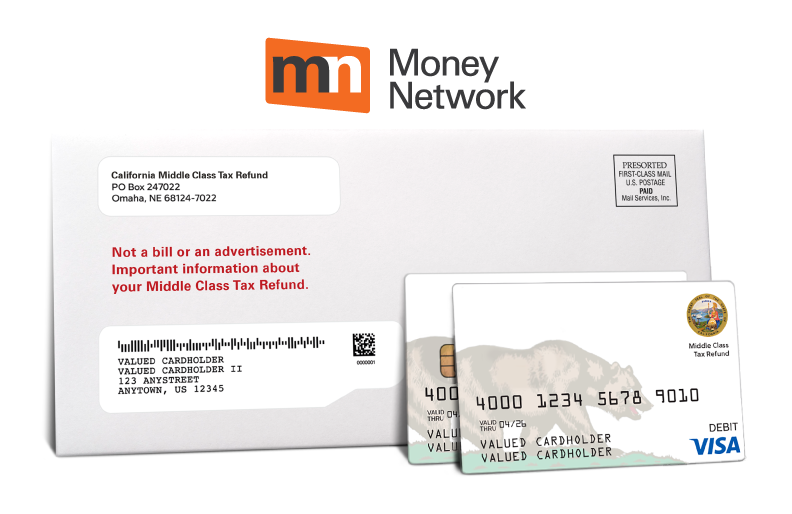

FTB has partnered with Money Network to provide payments distributed by debit card. Visit the Money Network FAQ page for details on making purchases, withdrawals, and transfers with your debit card payment.

Note the return address of the envelope is Omaha, NE.

Debit card recipients that have not activated their payment card were mailed a reminder letter that includes instructions on activating their debit card.

-

Determine your eligibility

You were eligible if you:

- Filed your 2020 tax return by October 15, 2021[i]

- Met the California adjusted gross income (CA AGI) limits described in the What you may have received section

- Were not eligible to be claimed as a dependent in the 2020 tax year

- Were a California resident for six months or more of the 2020 tax year

- Were a California resident on the date the payment was issued

[i] To receive your payment, you must have filed a complete 2020 tax return by October 15, 2021. However, if you applied for an Individual Taxpayer Identification Number (ITIN) but did not receive it by October 15, 2021, you must have filed your complete 2020 tax return on or before February 15, 2022. ↵Return to place in article

-

How payments were issued

Californians received their MCTR payment by direct deposit or debit card.

Generally, direct deposit payments were made to eligible taxpayers who e-filed their 2020 CA tax return and received their CA tax refund by direct deposit. MCTR debit card payments were mailed to the remaining eligible taxpayers.

You should have received your payment by mail in the form of a debit card if you:

- Filed a paper return

- Had a balance due

- Received your Golden State Stimulus (GSS) payment by check

- Received your tax refund by check regardless of filing method

- Received your 2020 tax refund by direct deposit, but have since changed your banking institution or bank account number

- Received an advance payment from your tax service provider, or paid your tax preparer fees using your tax refund

-

When payments were issued

Direct deposit payments Recipients Payment issue date GSS I or II direct deposit recipients 10/07/2022 through 10/25/2022 Non-GSS recipients 10/28/2022 through 11/14/2022 Debit card payments Recipients Debit card mailing timeframe GSS I or II check recipients (last name beginning with A – E) 10/24/2022 through 11/05/2022 GSS I or II check recipients (last name beginning with F – M) 11/06/2022 through 11/19/2022 GSS I or II check recipients (last name beginning with N – V) 11/20/2022 through 12/03/2022 GSS I or II check recipients (last name beginning with W – Z) 12/04/2022 through 12/10/2022 Non-GSS recipients (last name beginning with A – K) 12/05/2022 through 12/17/2022 Non-GSS recipients (last name beginning with L – Z) 12/19/2022 through 12/31/2022 Direct deposit recipients who have changed their banking information since filing their 2020 tax return 12/17/2022 through 01/14/2023 Debit card recipients whose address has changed since filing their 2020 tax return 01/30/2023 through 02/14/2023 -

What you may have received

Refer to the tables below to determine your payment amount.

For your CA AGI, go to:

- Line 17 on your 2020 Form 540

- Line 16 on your 2020 Form 540 2EZ

Married/RDP filing jointly CA AGI reported on your 2020 tax return Payment with dependent Payment without dependent $150,000 or less $1,050 $700 $150,001 to $250,000 $750 $500 $250,001 to $500,000 $600 $400 $500,001 or more Not qualified Not qualified Head of household or qualifying widow(er) CA AGI reported on your 2020 tax return Payment with dependent Payment without dependent $150,000 or less $700 $350 $150,001 to $250,000 $500 $250 $250,001 to $500,000 $400 $200 $500,001 or more Not qualified Not qualified Single or married/RDP filing separately CA AGI reported on your 2020 tax return Payment with dependent Payment without dependent $75,000 or less $700 $350 $75,001 to $125,000 $500 $250 $125,001 to $250,000 $400 $200 $250,001 or more Not qualified Not qualified

Contact information

Customer support is available in English, Spanish, Mandarin, Hindi, Vietnamese, Korean, and Punjabi. Other languages may be supported by request.

- Chat

- Available at MCTRPayment.com

Weekdays, 8AM to 5PM - Automated customer support

- 800-542-9332

Weekdays, 8AM to 5PM - Debit card questions

- Assistance with activation, replacement, lost, or stolen card

800-240-0223

Card activation available 24/7

Customer support available weekdays, 8AM to 5PM - Online

- mctrpayment.com