Tax News October 2025

Tax News October 2025

Welcome to Tax News

Subscribe to get monthly updates on tax laws, policies, and events.

In this edition

- Tax News Flash - Amended Market-Based Sourcing Rules

- 2025 Indexing

- Amended Market-Based Sourcing Rules Effective October 1, 2025

- Extended Due Date for C Corporations

- Los Angeles County Disaster Relief and Assistance Reminder

- New Online Services: Offer in Compromise and Innocent Joint Filer

- Website Redesign

- Access FTB’s Data, Reports, and Plans

- Internal Revenue Service Updates

- Ask the Advocate - The Importance to Verify Power of Attorney Relationships: Protect your Clients and Prevent Fraud

Tax News Flash

September 12, 2025 - Amended market-based sourcing rules

2025 Indexing

Announcing the 2025 tax tier indexed amounts for California taxes.

We update the following annually:

- State income tax brackets

- Filing requirement thresholds

- Standard deduction

- Certain credits for inflation (based on the California Consumer Price Index (CCPI)

This year the inflation rate, measured by the CCPI for all urban consumers from June 2024 to June 2025, was 3.0%. Last year, California's inflation rate measured at 3.3%.

The complete 2025 tax rates and exemption amounts will be available on FTB's website in late December. The following are some of the changes:

| Filing status | 2024 Amounts | 2025 Amounts |

|---|---|---|

| Standard deduction for single or married filing separate taxpayers | $5,540 | $5,706 |

| Standard deduction for joint, surviving spouse, or head of household taxpayers | $11,080 | $11,412 |

| Personal exemption credit amount for single, separate, and head of household taxpayers | $149 | $153 |

| Personal and senior exemption credit amount for joint filers or surviving spouses | $298 | $306 |

| Dependent exemption credit | $461 | $475 |

| Renter's Credit is available for single filers with adjusted gross incomes of | $52,421 or less | $53,994 or less |

| Renter's Credit is available for joint filers with adjusted gross incomes of | $104,842 or less | $107,988 or less |

2025 California tax rate schedules

Single or married/RDP filing separately

If the amount on Form 540, line 19 is:

Schedule X

| Over- | But not over- | Enter on Form 540, line 31 |

|---|---|---|

| $0 | $11,079 | $0.00 +1.00% of the amount over $0 |

| 11,079 | 26,264 | 110.79 + 2.00% of the amount over 11,079 |

| 26,264 | 41,452 | 414.49 + 4.00% of the amount over 26,264 |

| 41,452 | 57,542 | 1,022.01 + 6.00% of the amount over 41,452 |

| 57,542 | 72,724 | 1,987.41 + 8.00% of the amount over 57,542 |

| 72,724 | 371,479 | 3,201.97 + 9.30% of the amount over 72,724 |

| 371,479 | 445,771 | 30,986.19 + 10.30% of the amount over 371,479 |

| 445,771 | 742,953 | 38,638.27 + 11.30% of the amount over 445,771 |

| 742,953 | & OVER | 72,219.84 + 12.30% of the amount over 742,953 |

Married/RDP filing jointly or qualifying widow(er)

If the amount on Form 540, line 19 is:

Schedule Y

| Over- | But not over- | Enter on Form 540, line 31 |

|---|---|---|

| $0 | $22,158 | $0.00 +1.00% of the amount over $0 |

| 22,158 | 52,528 | 221.58 +2.00% of the amount over 22,158 |

| 52,528 | 82,904 | 828.98 +4.00% of the amount over 52,528 |

| 82,904 | 115,084 | 2,044.02 + 6.00% of the amount over 82,904 |

| 115,084 | 145,448 | 3,974.82 + 8.00% of the amount over 115,084 |

| 145,448 | 742,958 | 6,403.94 + 9.30% of the amount over 145,448 |

| 742,958 | 891,542 | 61,972.37 + 10.30% of the amount over 742,958 |

| 891,542 | 1,485,906 | 77,276.52 + 11.30% of the amount over 891,542 |

| 1,485,906 | & OVER | 144,439.65 + 12.30% of the amount over 1,485,906 |

Head of household

If the amount on Form 540, line 19 is:

Schedule Z

| Over- | But not over- | Enter on Form 540, line 31 |

|---|---|---|

| $0 | $22,173 | $0.00 +1.00% of the amount over $0 |

| 22,173 | 52,530 | 221.73 + 2.00% of the amount over 22,173 |

| 52,530 | 67,716 | 828.87 + 4.00% of the amount over 52,530 |

| 67,716 | 83,805 | 1,436.31 + 6.00% of the amount over 67,716 |

| 83,805 | 98,990 | 2,401.65 + 8.00% of the amount over 83,805 |

| 98,990 | 505,208 | 3,616.45 + 9.30% of the amount over 98,990 |

| 505,208 | 606,251 | 41,394.72 + 10.30% of the amount over 505,208 |

| 606,251 | 1,010,417 | 51,802.15 + 11.30% of the amount over 606,251 |

| 1,010,417 | & OVER | 97,472.91 + 12.30% of the amount over 1,010,417 |

Amended Market-Based Sourcing Rules Effective October 1, 2025

The Office of Administrative Law approved amendments to California Code of Regulations (CCR), title 18, section 25136-2. The amendments were filed with the Secretary of State on August 27, 2025, and have an effective date of October 1, 2025.

CCR 25136-2 applies to apportioning taxpayers and provides rules for assignment of sales of other than sales of tangible personal property, which are based on the taxpayer’s market for the sales. Key changes with the new amendments include specific sourcing rules for certain industries and changes to clarify the rules for sales of services, sales that consist of a mix of services and/or properties, and sales from marketable securities.

For more information, go to final regulations.

Extended Due Date for C Corporations

The extended due date to file Form 100, California Corporation Franchise or Income Tax Return, is the 15th day of the 11th month after the close of the C corporation's taxable year. For example, for C corporations operating under a calendar year, the extended due date is November 15, 2025. The original due date for this return is the 15th day of the fourth month after the close of the C corporation's taxable year, which is April 15 for calendar year filers.

Please note this seven-month automatic extension to file does not apply to the payment of the C corporation's tax liability. The C corporation is required to pay its tax liability by the original due date of April 15, whether or not it files its return later using the seven-month extension.

If a C corporation does not file its return by the extended due date, then the extension does not apply, and any applicable late filing penalties will be calculated from the original due date of April 15.

Get more information at C corporations.

For more information about other business entity due dates, go to business due dates.

Los Angeles County Disaster Relief and Assistance Reminder

Disaster Relief

FTB reminds individuals and businesses with their principal residence, or principal place of business, in Los Angeles County during the fires that began January 7, 2025, that they qualify for a postponement to file and pay taxes until October 15, 2025. To notify FTB, affected taxpayers must write the name of the disaster (e.g., LA County Fires) at the top of their tax return for paper filed returns. Taxpayers who file electronically need to follow their software instructions to enter disaster information.

Only income tax filings and payments due between January 7, 2025, and October 15, 2025, qualify for a postponement to October 15, 2025. Refer to Los Angeles County fires and disaster declaration tax payments for examples of tax returns and payments eligible for postponement.

Individuals and businesses do not need to file FTB 3872 as the California and federal postponement periods are the same for the Los Angeles County disaster.

Disaster Assistance

Los Angeles County individuals and businesses who did not mark “disaster” on their tax returns and received penalty notices, or taxpayers and tax professionals who have questions about disaster relief, should contact FTB by:

- Online: MyFTB

- Email: LA County disaster relief

- Phone: 888-825-9868 (operative through October 15, 2025)

The email address and phone number options are only for individuals and businesses affected by the Los Angeles County disaster. The designated phone number will remain active through October 15, 2025, and the dedicated email will remain available thereafter.

For frequently asked questions, go to help with Los Angeles County fire relief. Taxpayers with questions not related to the Los Angeles County fires may use one of the many options to contact FTB.

New Online Services

We are excited to introduce two more online services which will be available early October for taxpayers, tax professionals, and small business owners.

Offer in Compromise

Allows individuals, business entities, and tax professionals to submit an offer in compromise (OIC) through their MyFTB account. Tax professionals must have an active POA and full online account access. Individuals and business entities can submit an OIC at FTB.ca.gov after creating a basic account.

For more information, go to make an offer on your tax debt.

Innocent Joint Filer

Will allow taxpayers and tax professionals to request Innocent Joint Filer relief through their MyFTB account. Tax professionals must have an active POA and full online account access.

Taxpayers can also request Innocent Joint Filer relief through FTB.ca.gov after creating a basic account.

For more information, review tax debt relief for spouse.

Website Redesign

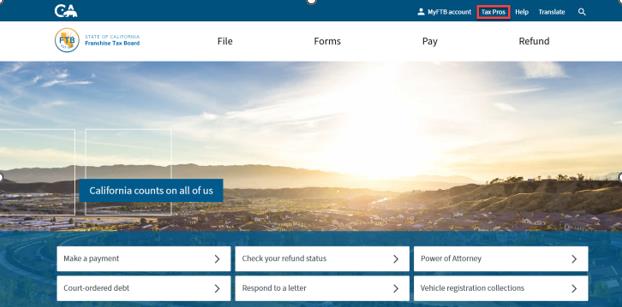

In the August publication of Tax News, we shared that the external website will undergo a redesign. We are proud to announce we successfully deployed the upgrade in the final week of September 2025.

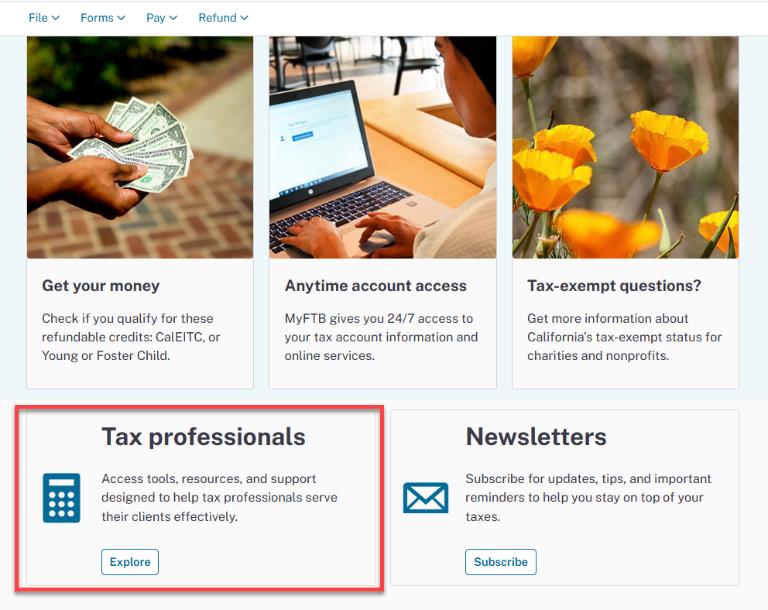

One of the changes made was to relocate the link for Tax Pros on our homepage.

The link is now located further down on the page, as a large card accompanied by a visual icon. The new location allows for the increased size and visual icon, making it easier for users to find the Tax Pros section on our website.

We also added a link to our newsletter section, next to the Tax Pros link. Previously, the only link to our newsletter subscription page was in the Newsroom section of our website. Our goal with this change is to make it easier for users to subscribe for additional communications from FTB.

Tax Pros link on old website homepage

Tax Pros link on new website homepage

The upgrade and redesign (known as the California Design System) is a key part of our digital strategy to improve overall user experience and mobile performance, enhance accessibility, and better reflect the needs of our customers.

We welcome your feedback and suggestions so we can continue to improve our website.

Access FTB’s Data, Reports, and Plans

Explore historical tax data, revenue reports, and key statistics any time through FTB’s publicly available online data portal. The data available on the Open Data Portal includes FTB’s Annual Reports and Department of Finance (DOF) Exhibits. FTB’s Annual Reports provide statistical research data including number of returns filed, income reported, and tax assessed for California business and individual taxpayers. The DOF Exhibits publish data semi-annually that forecast personal income and corporation tax revenue for California.

Go to data, reports, and plans and click on visit open data portal for additional information.

Internal Revenue Service (IRS) Updates

We partnered with the IRS to provide monthly IRS articles to assist our tax professional and small business communities, and we are excited to share this information; however, questions about the content should be directed to the IRS.

IR-2025-92, Sept. 19, 2025 — The Department of the Treasury and the IRS provided guidance on “no tax on tips” provision. The One, Big, Beautiful Bill proposed regulations identify occupations customarily and regularly receive tips and define “qualified tips” eligible taxpayers may claim as a deduction.

Treasury, IRS issue final regulations on new Roth catch-up rule, other SECURE 2.0 Act provisions

IR-2025-91, Sept. 15, 2025 — The Department of the Treasury and the IRS issued final regulations addressing several SECURE 2.0 Act provisions relating to catch-up contributions.

IRS assesses $162 million in penalties over false tax credit claims tied to social media

IR-2025-90, Sept. 8, 2025 — The IRS is alerting taxpayers about a growing number of fraudulent tax schemes circulating on social media that promote the misuse of credits such as the Fuel Tax Credit and the Sick and Family Leave Credit.

IRS urges emergency preparedness ahead of peak disaster season

IR-2025-89, Sept. 4, 2025 — As hurricane season peaks and wildfire risks remain high, the IRS urges individuals and businesses to create or update their emergency preparedness plans as part of National Preparedness Month.

Ask the Advocate

The Importance to Verify Power of Attorney Relationships: Protect your Clients and Prevent Fraud

Angela Jones, Taxpayers’ Rights Advocate

As trusted tax professionals, you play a vital role to help taxpayers navigate their California tax issues. The Franchise Tax Board (FTB) values the critical partnership they share with you to ensure that taxpayer’s private information is safeguarded. In fact, it is their paramount foundational principle to protect the “privacy and security of data entrusted to them.”

When you submit a Power of Attorney (POA), you ask FTB to recognize your authority to represent your client. Since this provides you access to private tax records, verification is essential to safeguard taxpayer rights and prevent fraud. The verification process may sometimes feel like an inconvenience or create short-term delays. However, these measures are necessary to ensure only authorized representatives gain access to taxpayer accounts, and to prevent bad actors from exploiting the tax system.

Real world bad actors

Fraudulent attempts to gain access to taxpayer accounts is an unfortunate reality. A preparer breach happened between 2016 and 2018, when a major scheme defrauded the U.S. government of over $17 million by filing false tax returns using stolen personal data. Cybercriminals from countries including Nigeria and Vietnam hacked into real CPA firms to submit large batches of fraudulent returns. A key breakthrough came when a victim received an FTB authentication notice, alerting authorities to the suspicious activity. This led to a successful state and federal investigation and prosecution.

Research revealed that an individual created a MyFTB practitioner account using stolen identity and tax information. He then fraudulently added POA relationships for multiple taxpayers using stolen identities and shared secret information obtained from sources outside FTB. He received refunds before fraud was even detected. Real world bad actors

This case underscores why FTB must remain vigilant and why it is critical to verify POA relationships for taxpayers and their representatives. Verification may feel like an annoying administrative step, but it plays a big role to protect taxpayers and maintain trust.

Partnership to protect your clients

By working in partnership, tax professionals and FTB strengthen safeguards to protect taxpayer data, while you have the access you need to effectively serve them. The verification process may take up to 15 days; that time is a worthwhile investment to protect taxpayers. Prioritizing privacy builds a foundation of trust, which ultimately enhances the customer experience in the long run. Thank you for your partnership to keep taxpayer data safe.