Taxpayers’ Rights Advocate’s Office Taxpayers’ Bill of Rights Annual Report to the Legislature

Mandates

Taxpayers’ Bill of Rights Legislation

In 1988, the California Legislature enacted the Taxpayers’ Bill of Rights. For the first time, legislation spelled out California taxpayers’ rights and FTB’s obligations. This law codified many existing departmental procedures and established a Taxpayers’ Rights Advocate.

On July 30, 1996, the federal Taxpayers’ Bill of Rights 2 passed, followed a few months later by California Taxpayers’ Rights Conformity Legislation.

California lawmakers enacted the Taxpayers’ Bill of Rights Act of 1999 to further guarantee taxpayers’ rights.

Taxpayers’ Rights Advocate’s Responsibilities

The Taxpayers’ Rights Advocate directly reports to FTB’s Executive Officer. As enacted by the legislature in the California Revenue and Taxation Code (R&TC), or as otherwise delegated by the FTB, the Taxpayers’ Rights Advocate or his or her designee:

- Coordinates the resolution of taxpayer complaints and problems, including complaints about unsatisfactory treatment by FTB employees

- Develops and implements a taxpayer education and information program.

- Identifies areas of recurrent taxpayer noncompliance.

- Conducts an annual hearing where individual taxpayers and industry representatives may present proposals to clarify the California R&TC.

- Makes recommendations to improve taxpayer compliance and uniform tax administration.

Mission

Our mission is to provide quality service to taxpayers and tax professionals through:

- Education and Outreach – We educate and engage taxpayers and tax professionals by addressing changes in law, the most common return filing errors, and by providing useful and timely information about FTB. We solicit feedback from external stakeholders about FTB services, policies, and procedures to improve transparency and the quality of the services provided.

- Case Advocacy – We assist individuals and businesses with problems ranging from customer service concerns to complex audit and filing issues not resolved through normal channels.

- Systemic Advocacy – We work with external stakeholders to identify, analyze, and resolve broad-based taxpayer problems, including issues that require a legislative solution. We provide input to FTB on behalf of taxpayers and tax professionals.

Programs

Coordination of Taxpayer Complaints and Problems

Taxpayers’ Right’s Advocate Office

FTB receives assistance requests from taxpayers every year. In conjunction with the Department, and consistent with R&TC Section 21004, the Taxpayers’ Rights Advocate (Advocate) or his or her designee shall be responsible for coordinating the resolution of taxpayer complaints and problems by reviewing their unresolved tax problems and ensuring that their issues are handled promptly and fairly.

The following cases illustrate how the Taxpayers’ Right’s Advocate Office (TRAO) coordinates the resolution of taxpayers’ complaints or problems by working cooperatively with FTB staff. In particular, these cases show how TRAO is able to take a fresh and independent look at a matter and recommend procedural or other changes to the Department to ensure taxpayers’ positions are given due consideration.

Equity Relief

Senate Bill (SB) 540 (Stats. 2015, Ch. 541, Sec. 1), effective January 1, 2016:

- Extended and made permanent the Taxpayers’ Rights Advocate (in coordination with Chief Counsel of the Board) penalty, interest, and fee relief provisions.

- Increased the relief limitation to $10,000, indexed annually for inflation; the limit was indexed to $10,900 for 2019.

- Maintained the requirement for the concurrence by the Executive Officer of the Board with any relief granted in which the total reduction exceeds $500.

When relief is granted, the three-member Board shall be notified and a public record placed on file for at least one year.

During FY 2018/2019, the Advocate granted equity relief of $10,900 to one individual. As a result of an Internal Revenue Service (IRS) audit, the taxpayer filed an amended 2009 individual tax return – 540X to report corresponding California adjustments to income and expenses. The return was filed August 2013 and the taxpayers paid additional tax, as amended, but did not include interest as required. The case was subject to review and a hold was placed on the account. No additional action was taken until October 2018. The return should have been reviewed and processed within FTB’s normal time frame so that billing could start. However, it was overlooked for an unknown reason, which caused the delay. After a discussion with the program manager, the delay was determined to be an isolated incident. However, program management plans to review the workload to identify opportunities for improvement.

Executive and Advocate Services (EAS)

Taxpayers are assisted by reviewing their unresolved tax problems and ensuring that their issues are handled promptly and fairly. Taxpayers or their representatives request advocate assistance when they are unable to resolve their issues through normal channels. The Governor’s Office, three-member Franchise Tax Board, FTB employees, legislators, state and federal agencies, and taxpayers or their representatives contact us by mail, fax, telephone, and email.

EAS staff responded to more than 14,400 telephone calls and approximately 6,400 pieces of correspondence (letters, faxes, and emails) during FY 2018/2019 seeking advocate and other types of assistance. A public number is available (800.883.5910) for taxpayers to contact the Department to request advocate assistance.

The top five reasons personal income taxpayers requested advocate assistance in FY 2018/2019 included:

- Billing notices, which includes:

- Wage Garnishments and Bank Levies

- Installment agreement (IA)

- Penalty Waiver

- Refund status, which includes:

- Withholding

- Claim for Refund

- Filing Enforcement (FE)

- Independent administrative review

- Audit

Some examples of assistance provided to personal income taxpayers include:

Wage Garnishments and Bank Levies

Determined why garnishments or bank levies were issued and provided explanations to taxpayers. If a hardship was found to exist, orders were modified or released as appropriate.

Filing Enforcements

Explained assessments and provided income information to assist taxpayers to complete their tax returns. In some cases, they canceled FTB’s assessments or addressed hardship issues.

Independent Administrative Review

Conducted independent administrative reviews for taxpayers who had their installment agreement (IA) requests rejected and requested a review in writing. During the review, EAS verified whether or not the Franchise Tax Board provided the taxpayer with due process and also determined if the taxpayer’s rights, as defined by the Taxpayers’ Bill of Rights, were violated. In some cases, the rejection was affirmed, a hardship collection deferral was granted, or the taxpayer’s IA request was accepted.

The top 5 reasons a business entity requested advocate assistance in FY 2018/2019 included:

- Penalty abatement

- Never conducted business in California but received a bill

- Disagree with prior FTB answer

- Revivor requests

- Missing/Misapplied Payments

Some examples of assistance provided to business entities included:

Penalty Abatement

Reviewed accounts for reasonable cause and proceeded accordingly within the confines of the R&TC. If it was determined the balance was valid, EAS worked with the taxpayer to establish a due date for payment or set up an IA.

Never Conducted Business, but Received a Bill

If a business entity is registered in the state and ceased doing business but neglected to dissolve properly, information is provided regarding our Voluntary Administrative Dissolution program. By applying and being accepted for the program, a Domestic corporation can avoid having to file or pay for tax years in which they did not conduct any business.

Revivor Request

When contacted for a revivor request, EAS provided direction on the need to file delinquent returns, pay any balance due, and submit any other documentation so that the revivor process could be completed.

Missing/Misapplied Payments

When a taxpayer calls about a missing payment, the taxpayer is asked to provide a copy of the canceled check, so that a search of our records can be performed. Once the payment is located, the account is analyzed and, if appropriate, payments are moved to the correct account or tax year.

Tax Appeals Assistance Program

The Tax Appeals Assistance Program (TAAP) for franchise and income tax has been administered by the TRAO since January 1, 2019. By partnering with several law schools throughout California, TAAP offers free legal assistance to low-income and underrepresented taxpayers who have appealed actions of FTB with the Office of Tax Appeals (OTA).

Franchise and personal income tax appeals

The program is offered to taxpayers who are appealing actions of the FTB. The amount in dispute must be less than $30,000. TAAP can assist with appeals involving the following tax issues:

- Head of household filing status

- Penalty relief

- Residency

- Request to remove or abate interest

- Statute of limitations

- Federal action (Notice of Proposed Assessment based on an action by the IRS)

- California’s method to tax nonresidents/part-year residents

- Child and dependent care credits

- Exemption credits

- Other state tax credits

- Personal income tax deductions

- Corporate minimum tax

- Innocent spouse claims

Under the guidance of an experienced supervising tax attorney, law school students, including graduate level tax students, represent appellants in their appeal cases. Five law schools are currently participating in the TAAP program: the Lincoln Law School of Sacramento, the Golden Gate University School of Law in San Francisco, the University of San Francisco School of Law, the Loyola Law School in Los Angeles, and the University of San Diego School of Law.

Program Benefits

Since its inception in 2006, TAAP has helped resolve hundreds of cases. Without this vital program, taxpayers would have to face the tax agency and the Office of Tax Appeals alone, hire representation they cannot afford, or just give up and pay the disputed bill.

TAAP is not only instrumental in helping numerous taxpayers with the appeal process, but also with helping taxpayers understand their tax issues. In doing so, many taxpayers have resolved and settled their cases with FTB prior to an oral hearing before the OTA. This year’s completed cases have fulfilled the purposes of the program which are to:

- Enhance the preparation and quality of the appeals going to the OTA.

- Provide taxpayer representation that promotes and achieves more efficient and cost-effective resolution of taxpayer petitions.

As of June 30, 2019, TAAP informed 285 individuals and businesses about the program, accepted 92 new cases, and resolved 60 cases. TAAP had 35 law students participate in the program and represented 2 taxpayers at oral hearings in front of the OTA in Los Angeles and in Sacramento.

The TAAP has been well received by all five law schools and makes a positive difference in the lives of its clients.

Develops and implements a taxpayer education and information program

Education and Outreach

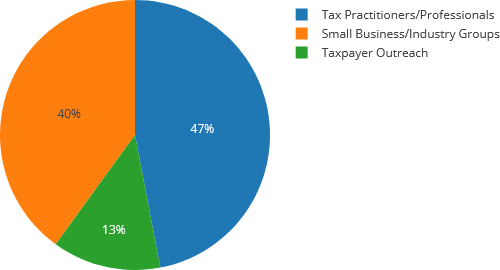

Education and Outreach helps nonprofit organizations, community groups, tax professionals, and government-funded educational institutions learn more about tax-related issues. Speakers typically present to groups of 25 or more. These groups can be tax professionals, small business owners, and taxpayers. We also provide non-English speakers upon request and availability. Education and Outreach is one of our ongoing efforts that acknowledge the continuing educational needs of tax professionals and nonprofit tax-related organizations. The following chart illustrates Education and Outreach presentations by audience group.

In our commitment to provide timely information to promote complete, accurate, and timely filed tax returns, we developed a California tax and FTB services update presentation and presented it throughout the year statewide.

This year’s presentations provided information, explanations, and promoted discussions about the following issues:

Advocate Services

We inform tax professionals about the Taxpayers’ Bill of Rights and let them know what services are available at FTB to assist them if they need help resolving an issue or complaint.

California Earned Income Tax Credit (EITC)

In 2018, California allowed a refundable credit to working families, similar to the federal EITC. The credit ranges from $232 to $2,879 for incomes from $16,750 to $24,950. A qualifying tier exists for families with three or more children who may be eligible for the maximum credit. Taxpayers must meet the following requirements to qualify for the credit:

- Lived in California for more than half the year.

- Based on wage and self employed income.

- Received less than $3,699 in investment income.

Gig Economy

It is estimated that one-third or more of all U.S. workers now work in the Gig Economy, also known as the shared, digital, or peer-to-peer economy. We provide information and resources that are available to tax professionals and their clients from a variety of sources, including FTB, IRS, EDD, and others.

Conformity

Federal tax laws changed significantly beginning with the 2018 tax year. California did not automatically conform to most of the changes, requiring major revisions and updates to both California income tax forms and the guidance we provide to tax professionals. We provide information about the most important federal/California differences and how these are addressed with our new forms. We also provide updated information on pending legislation regarding conformity and the procedures to follow whenever an election to conform to a specific federal provision becomes available.

Administrative Dissolution

Changes to California law, effective January 1, 2019, allow for the administration dissolution of certain domestic corporations and LLCs meeting specific criteria. These include not actively engaging in any transaction for the purpose of financial or monetary gain or profit, having stopped or doing business or never did business, and having no assets. Qualifying entities may request voluntary administrative dissolution or cancellation. This new process is beneficial to both FTB and the business entities, saving time and resources by removing dormant business entities from FTB’s accounts receiveables.

Right to Representation

When a taxpayer appoints a representative, we must work directly with the representative regarding all matters within the scope of the representative’s authorization, with the exception of criminal matters. The taxpayer’s right to representation must be respected by our employees at all times. However, we should continue to be responsive to any direct communication from the taxpayer, and we should include them in written correspondence sent to the representative, when appropriate.

Social Media

We have seen a rapid growth in the use of social media for communicating and disseminating information. We provide information to tax professionals about the various social media platforms used by FTB, including Facebook, Twitter, and YouTube. We also let them know about short informative YouTube videos presented by the Taxpayers’ Rights Advocate and staff on a variety of topics.

Cannabis

The advent of legal cannabis for adults has resulted in a significant demand for state tax information related to owning and operating a cannabis business. We provide resources and links to information from FTB, CDTFA, and EDD. Additionally, we provide updates on relevant legislation and the differences in federal and California law regarding the income tax treatment of cannabis businesses.

New POA Forms

FTB enhances its processes for POA forms on an ongoing basis. This includes updates to POA forms, how we process them, and how we inform representatives of the status of their pending request for POA authorization. We keep representatives informed about these changes and the improvements in our processing times for POA forms. We also let them know about the most common errors that result in POA forms being rejected.

Taxpayer Advocate Relief

The Taxpayers’ Rights Advocate, in coordination with the Chief Counsel and with concurrence of the Board’s Executive Officer, may grant relief from tax, penalty, and interest caused by erroneous actions or inactions or unreasonable delay by FTB, when no other relief is available (limited to $10,900 in 2019). In order for relief to be granted, the taxpayer must not have significantly caused the error or delay.

Small Business Outreach

We conduct seminars and develop programs to help small businesses meet their state income tax filing requirements. Together with the CDTFA, EDD, and IRS, we develop products that simplify the process to obtain information on most business filing requirements.

We participate in small business seminars sponsored by the CDTFA throughout California.

Our Small Business Liaison provides education and outreach to small businesses and answers phone calls from taxpayers. The liaison provides current and future small business owners and taxpayers with tax information about specific filing requirements based on their business ownership or proposed business ownership type. The liaison refers business owners and taxpayers to the appropriate program areas within our Department and to the other state or federal agencies to answer their questions. We answered nearly 1,200 calls from taxpayers, small business owners, and tax professionals who called our small business liaison phone line.

Tax News

Tax News products include our monthly online publication, email, videos, and social media. Our online publication, Tax News, remains the department’s primary external communication source to inform tax professionals about state income tax laws, regulations, policies, procedures, and events that affect the tax professional community. Our subscribership continues to grow at a steady pace. We partner with IRS and other state and county agencies to share pertinent information with their customers and our subscribers. Tax News continues to experience positive feedback, and trade media publications repost and quote our articles.

We use our email delivery service for Tax News Flashes sending only the most time-sensitive, vital information, such as sending critical information, updates, and resources for California’s wildfire victims.

Tax News Live released three new short videos – Market Based Sourcing, California State Income Tax (Gig Economy), and Offer in Compromise. We provide links from Tax News articles and FTB’s webpage, but these videos are on YouTube as a resource for tax professionals and taxpayers.

Annual meetings

On behalf of the Department, the Taxpayers’ Rights Advocate coordinates annual meetings with external stakeholders to better understand issues faced by industry and tax professionals. We also discuss proposed changes to legislation and to FTB’s tax administration practices.

FTB Advisory Board

Our Executive Officer’s Advisory Board meets annually and brings together representatives from industry, state, and federal government. The Board provides insight and contributions from a non-FTB point of view to our Executive Officer on various projects and the programs FTB administers.

The topics from our latest meeting included a discussion on conforming to various provisions of the 2017 federal TCJA, recent changes to FTB’s website in order to provide better accessibility, legal and litigation updates, and the administrative dissolution of dormant business entities.

Meetings with key Tax Professional Groups

We coordinate annual meetings with the California Society of Enrolled Agents (CSEA) and the California Society of Certified Public Accountants (CalCPA) to discuss issues important to the tax professional community. Topics discussed at last year’s meetings included online services available to tax professionals and their clients, important tax forms changes, FTB’s upcoming projects, and responses to questions submitted by CSEA and CalCPA on a variety of topics.

Bill of Rights Hearing

The Taxpayers’ Bill of Rights Act requires FTB to conduct an annual hearing before the three-member Board where tax professionals, industry representatives, and individual taxpayers are allowed to present their proposals on changes to the personal income or bank and corporation tax laws. FTB typically holds the hearing in December. Some of the issues raised at the 2018 Bill of Rights Hearing include:

- California conformity with the TCJA.

- Clarification regarding withholding credits from FTB Withhold-at-Source programs.

- Taxpayer Information Authorizations and Powers of Attorney for deceased taxpayers.

- FTB’s Voluntary Disclosure program.

- Audits of taxpayers are taking too long.

- Clarification of FTB’s position in light of the OTA decision regarding taxation of non-California service businesses.

- Allow joint estimated tax payments and joint return refunds to be applied directly to an individual account rather than be put in suspense until a return is filed claiming the credit.

- Increase publicity of the Bill of Rights Hearing to the general public.

- Have FTB acknowledge all claims for refund and provide taxpayer rights as part of the claim for refund process.

- Develop legislation for other state tax credits to avoid double taxation.

Copies of the complete responses can be found at ftb.ca.gov on the Taxpayer Advocate Services page.

Systemic Advocacy

We work with external stakeholders to identify, analyze, and resolve broad-based taxpayer problems, including issues that require a legislative solution. We provide input to FTB on behalf of taxpayers and tax professionals. As an example of systemic advocacy, during FY 2018/2019, we received two reports of issues regarding delays in payment processing. We forwarded both of the issues for research and resolution. As a result, staff completed a review of the workloads and processes to identify opportunities for improvement. New procedures were put in place to reduce the chance for any work to be overlooked.

Resources

We develop, review, and periodically revise our notices, forms, and publications to ensure our written content is accurate, clear, and current. We train staff to apply departmental writing standards and follow guidelines to meet readability requirements and technical accuracy. We include revision dates on all of our publications. We offer limited quantity translated publications in Spanish, Chinese, Korean, and Vietnamese.

Our tax booklets and notices include information about taxpayers’ rights. Our goal is to inform taxpayers in simple, nontechnical language about procedures, remedies, and their rights during audit, protest, appeal, and collection proceedings.

We provide detailed information about Taxpayers’ Bill of Rights legislation in our publications:

- FTB 4058, California Taxpayers’ Bill of Rights – Information for Taxpayers. This publication provides a basic overview of taxpayers’ rights and FTB’s obligations including the major provisions of the 1988, 1997, and 1999 California legislation.

- FTB 4058B, California Taxpayers’ Bill of Rights – Your Rights as a Taxpayer. A one-page overview of California Taxpayers’ Bill of Rights. This publication highlights some of taxpayers’ basic rights.

- FTB 4058C, California Taxpayers’ Bill of Rights – An Overview. This publication describes the R&TC provisions related to taxpayer rights and FTB obligations and how we implement them.

We also review external publications and communications for compliance with the Taxpayers’ Bill of Rights legislation.

MyFTB account

MyFTB account