FTB 2645 Publication Participation Guide for 2026 Revised: 10/2025

Changes to the IIC Program - 2026 Updates

1. Assembly Bill 194

This bill, for taxable years beginning on or after January 1, 2024, prohibits the Controller from offsetting delinquent accounts against the personal income tax refunds of an individual who received the California Earned Income Tax Credit (CalEITC) or the Young Child Tax Credit (YCTC) for the taxable year. The bill specifies that these provisions do not apply to delinquent accounts for the nonpayment of child or family support.

2. Senate Bill 131

This bill prohibits the Controller from offsetting delinquent accounts against the personal income tax refunds of an individual who received the Foster Youth Tax Credit (FYTC).

Coming Soon

Modified Debtor Accounts Rejected (FTB response file) will have additional fields of information to include all data elements submitted by agency on Modified Debtor Accounts file. Additional debtor name elements will assist agencies when reconciling error messages with corrective steps.

Chapter 1 — Interagency Intercept Collection (IIC) Program

- Overview

- Benefits

- Administrative Costs

- Authority

- Agency Responsibility

Overview

Many California taxpayers fail to settle outstanding debts owed to government agencies and California colleges. Yet, these individuals are scheduled to receive state payments that include FTB personal income tax refunds, Unclaimed Property Division (UPD) claim payments, or California State Lottery winnings.

FTB administers the Interagency Intercept Collection Program (IIC Program) on behalf of the State Controller’s Office (SCO). The program intercepts these funds to pay the individual’s debts to agencies and colleges (hereinafter collectively referred to as agency). The IIC Program does not intercept corporation, limited liability company, or partnership funds.

History

The IIC Program has been in existence since 1975, initially intercepting only Personal Income Tax refunds. We included lottery winnings in 1984 and added unclaimed property payments in 2009. In 2023, IIC redirected $369 million for over 600 participating agencies.

Administrative Costs

Participation costs will vary each year, SCO and FTB calculate the program’s annual cost. The cost is divided by the number of successful offsets for the calendar year. The cost is generally between $2-3 per successful offset; however, it can be up to $10 per successful offset.

In April or May, SCO sends a billing invoice for successful offsets that occurred during the previous calendar year. If the participating agency fails to pay fees within 30 days of the billing date, fees may be deducted from any future money intercepted or participation in the program may be suspended until payment is made.

Authority

The government code sections in the following table relate to the IIC Program. These codes determine the exact debts that can be submitted to the IIC Program.

| Reference | Description |

|---|---|

| California Government Code (GC) Sections 12419.2-3, 12419.5, and 12419.7-12 |

|

| California Revenue and Taxation Code (R&TC) Sections 19542, 19542.1, and 19552. | Provides misdemeanor criminal penalty and taxpayer notification for unwarranted disclosure or use of confidential taxpayer information. |

| GC Section 12419.8 and 12419.10 (R&TC) Section 19551 | Authorizes city and county tax officials pursuing property tax debts to request social security numbers (SSNs). |

| State Administrative Manual (SAM) 8293.4 |

|

| SAM 8293.1 | Outlines state agencies’ collection procedures prior to offset. |

| GC Section 926.8 | Authorizes the Internal Revenue Service (IRS) to intercept funds. |

Agency Responsibility

- Submit correct information for each debtor including, but not limited to social security number, name, and balance due.

- FTB requires agencies to respond to their debtor within 48 hours when contacted by FTB staff, to ensure issues are resolved and customer needs are met.

- Refund over collection.

Failure to cooperate, communicate, and/or provide resolution may result in a suspension of intercepts for your agency.

Chapter 2 — Eligibility

- Qualifying Participants

- Qualifying Debts

- Debt Criteria

Qualifying participants

To be eligible for the IIC Program, the agency must be:

- A California state, city, county agency, or special district.

- A California state college, community college district, or other post-secondary educational institution.

All agencies must read, sign, adhere to, and maintain FTB 7904, Vendor/Contractor Confidentiality Statement, and the Interagency Intercept Collection Program Special Terms and Conditions, refer to Chapter 4. Agencies need to identify and maintain these documents for every employee within their agency that has access to the daily and weekly reports. To get a copy of the Vendor/Contractor Confidentiality Statement go to ftb.ca.gov and search for 7904. This requirement applies, but is not limited to, agency/vendor IT department staff, agency/vendor management, agency/vendor fiscal staff, agency/vendor collector staff, etc. It is the responsibility of the agency, college, or district to safeguard the data as outlined in the Interagency Intercept Collection Program Special Terms and Conditions.

Failure to maintain and comply with FTB 7904 and the Interagency Intercept Collection Program Special Terms and Conditions could result in unauthorized access, disclosure or use. Penalties for unauthorized access, disclosure, or use could result in fines and imprisonment under California Law (R&TC Sections 19542, 19542.1, and 19552. GC Section 90005). Penalties may extend to the signature and names listed on FTB 2280 PC, Intent to Participate and Agency Certification and FTB 2280A PC, Intent to Participate - Identification Search as well as individuals listed on FTB 7904.

FTB may request a completed copy of FTB 7904 at any time.

Qualifying debts

Many debts qualify for the IIC Program:

- State agencies can submit any type of debt owed to them.

- Counties and cities can submit debts for property taxes, delinquent fines, bails, vehicle parking penalties, court-ordered payments, or other permitted debts.

- California colleges (and other post-secondary educational institutions) can submit debts to us for delinquent registration, tuition, bad check fees, library fines, federally subsidized student loans, or other permitted debts.

- Special districts can submit debts in accordance with GC Sections 12419.8, 12419.10, and 12419.12.

Consult with your legal department to determine acceptable debts. FTB will not advise on acceptable debt types for collection.

Debt criteria

Submit debts only if,

- The debt type qualifies under the IIC Program authority and SCO approved it.

- A Pre-Intercept Notice was mailed and the appropriate response time elapsed. Refer to the Steps for Participation section for more information on the notice requirement.

- The debtor has a valid social security number (SSN).

- For city and county tax officials who pursue property tax debts, the IIC Program can manually research SSNs for a fee (approximately $6 each). Use FTB 2284 PC, Request for Social Security Number Search, for this service. (R&TC Section 19551 and GC Sections 12419.8 and 12419.10)

- Refer to Chapter 7 — ID Lookup to submit debts without SSNs through Secure Web Internet File Transfer (SWIFT).

- There is one debt amount for each debtor. If one debtor has multiple accounts with an agency, sum the debtor’s total and submit it as one account balance item. If the debtor’s multiple accounts are listed separately, the IIC Program only accepts the first account.

- The debt amount is at least $10.

- The debtor cannot be in an active bankruptcy.

- The debt amount cannot include any amount that was discharged by a discharge order granted in a bankruptcy case.

Chapter 3 — The IIC Process

- Load and Maintain Debtor Data.

- Revenue Sources.

- Distribute Intercept Payments According to Debt Priority.

- Notify Parties of Intercepts.

- Update Records with Intercepts.

Load and maintain debtor data

Participating agencies submit delinquent debtor accounts to the IIC Program through Secure Web Internet File Transfer (SWIFT). We compare the debtor’s SSN and name elements provided in the agency’s record with the SSN and name elements in our system. Both SSN and name are required to match to intercept a payment. Agencies may send debtor files weekly or daily. The IIC Program accepts up to five offset requests from separate agencies for the same debtor. If an account is rejected, FTB will send a report via SWIFT on a Rejected Accounts Report detailing the debtor account information and the reason for rejection. Refer to the File Exchange Guidelines section for more information on rejected accounts.

Revenue sources

California personal income tax refunds, lottery winnings, and unclaimed property assets.

Distribute intercept payments according to debt priority

If a match on both SSN and name occurs, our system will determine the amount distributed to each participating agency according to the following account hierarchy (GC Section 12419.3):

- Child or family support enforced by a local agency.

- Child or family support enforced by a nonlocal agency.

- Spousal support enforced by a local agency.

- Spousal support enforced by a nonlocal agency.

- Restitution Fund.

- Benefit overpayments pursued by the Employment Development Department.

(If there is no signed reimbursement agreement, or if there are two consecutive delinquent reimbursement payments).

- SCO determines the priority of all other account types.

If a higher priority account is paid in full, then funds are directed to the next priority agency. The process is repeated until all accounts are paid or until all offset funds are exhausted. If there are multiple identical priority accounts, then funds are directed to the account with the largest liability.

Notify parties of intercepts

The IIC Program will notify the participating agency and debtor when an intercept occurs. IIC will also send the debtor an Intercept Funds Notice containing the following information:

- Debtor’s account number with the agency.

- Original payment amount.

- Intercepted amount.

- Remaining monetary amount, if any.

- Agency’s public contact address and phone number.

- GC authorizing the IIC Program.

Update records with intercepts

FTB updates debtor records with Intercepts to reduce the debt amounts and will notify SCO about the previous month’s intercepts. SCO credits these funds to the appropriate participating agency. Some state agencies receive a transfer memorandum. All other agencies receive a warrant. The IIC Program may reduce the monthly payment amount by any reversals that occur during the month. Refer to Reversals, for more information.

Chapter 4 — Program Requirements

The following must take place to participate in the IIC Program:

- Certify program participation annually and agree to meet all program and debt eligibility requirements.

- Provide updated certification and contact information when changes occur.

- Assign liaison(s) to respond to debtor assistance requests by IIC staff regarding debtor’s questions of their account(s).

- Provide public contact information to your debtors using FTB 2280 PC, Intent to Participate and Agency Certification. The public contact information will be provided on your debtor’s FTB 4141 Intercept Funds Notice.

- Send each debtor a Pre-Intercept Notice at least 30 days prior to submitting debts in accordance with SAM Section 8293.

- Update debts immediately upon learning any of the following has occurred:

- A debt is paid in full.

- Agency receives payments outside of intercepts.

- Debtor has filed bankruptcy.

- A debt was submitted in error.

- Refund debtors any amount we over collected.

- Reimburse FTB for erroneous intercepts (reversals).

- Pay the IIC Program service fees. Failure to pay your fees within 30 days of the billing date may result in deduction of the fees from any money we intercept for the participating agency.

- Follow confidentiality guidelines:

- Only use debtor information provided for the requested purpose.

- Ensure that all information provided is safeguarded (in accordance with the Internal Revenue Service Publication 1075, Tax Information Security Guidelines for Federal, State, and Local Agencies).

- Only send confidential information in a secure environment, never through unsecured email. (R&TC Sections 19542 and 19542.1).

- Recognize unauthorized disclosure or use of confidential information is a misdemeanor.

FTB thoroughly reviews all unauthorized or suspected access, use, and/or disclosure (incidents) of the information obtained under this agreement. FTB complies with the incident reporting requirements, in accordance with Civil Code Section 1798.29 and SAM Chapter 5300 (Information Security). The participant shall immediately notify FTB’s Information Security Audit Unit (ISAU) of any unauthorized or suspected unauthorized accesses, uses, and/or disclosure (incidents). Email ISAU at, SecurityAuditMail@ftb.ca.gov or call 916-845-5555. Notify the Information Security Audit Unit of all incidents involving the information obtained under this agreement as applicable, and provide the appropriate information to facilitate the required reporting to the taxpayers or state oversight agencies.

- Complete and sign FTB 7904, Vendor/Contractor Statement. Maintain FTB 7904 throughout the year.

- Follow the Interagency Intercept Collection Program Special Terms and Conditions.

Interagency Intercept Collection Program special terms and conditions

- Statement of confidentiality

-

The Franchise Tax Board (FTB) has taxpayer returns and other confidential data and information in its custody. Any data or information provided by FTB and maintained on the agency’s or its vendor’s premises is confidential. Unauthorized inspection or disclosure of state returns or other confidential data or information is a misdemeanor. R&TC 19542, 19542.1, and 19542. Unauthorized inspection or disclosure or federal returns and other confidential federal returns or information is a misdemeanor or a felony. (Internal Revenue Code 7213(a)(2) and 7213A(a)(2), respectively.) Agencies and their vendors and their respective employees will not enter any premises, access any computers, software, applications, data, or information not specifically required by the authorized duties, nor will they refer to or read any documents that come within their view other than those related to the authorized duties.

Each agency and its vendor, and each of their employees who may have access to the confidential or sensitive information or data of FTB, will be required to have on file annually a signed FTB 7904, Vendor/Contractor Confidentiality Statement, attesting to the fact that they are aware of the confidential data and the penalties for unauthorized disclosure thereof under applicable state and federal law. In addition, as a condition to receiving any FTB confidential data or information under this agreement, whether directly from FTB or indirectly from the participating agency, the participating agencies and its vendors authorized representative(s) shall sign an Acknowledgment and Agreement to Interagency Intercept Collection Program – Special Terms and Conditions, which shall acknowledge awareness of the terms and conditions of Interagency Intercept Collection Program – Special Terms and Conditions, that access to FTB confidential data or information is conditioned upon agreement to those terms and conditions, and acceptance of the terms and conditions therein.

- Use of information

-

The participating agency and its vendor agree that the data or information furnished or secured pursuant to the IIC Program shall be used solely for the purposes described in FTB 2645, IIC Program Participation Guide for 2025. The participating agency and its vendor each further agree that the data or information obtained under this Agreement will not be reproduced, published, sold, or released in original or any other form for any purpose other than as identified in FTB 2645.

- Data ownership

-

The confidential tax information or sensitive data or information being provided to the participating agency or its vendor in the IIC Program and under this agreement remains the exclusive property of FTB. Confidential tax and sensitive data and information are not open to the public and require special precautions to protect from loss and unauthorized use, disclosure, modification, or destruction. The participating agency and its vendor shall have the right to use and process the disclosed information for the purposes stated in FTB 2645, which right shall be revoked and terminated immediately upon termination of program participation, or as provided in paragraph 11 (“Denial of Access to Vendor”).

- Employee access to information

-

The participating agency and its vendor each agree that the data and information obtained will be kept in the strictest confidence and shall make data or information available to its own employees only on a need to know basis. The need to know standard is met by authorized employees who need the information to perform their official duties in connection with the uses of the data or information authorized by the IIC Program. The participating agency and its vendor each recognize their responsibilities to protect the confidentiality of the data or information in their custody as provided by law and ensure that such data or information is disclosed only to those individuals and for such purposes as are authorized by law, this agreement, and purposes stated in FTB 2645.

- Protecting confidential information/incident reporting

-

The participating agency and its vendor, in recognizing the confidentiality of FTB data and information, each agree to take all appropriate precautions to protect from unauthorized disclosure or use the confidential information data or obtained pursuant to the IIC Program and this agreement. The agency and its vendor each will conduct oversight of their users with access to the confidential data and information provided under this agreement and will immediately notify FTB’s Information Security Audit Unit (ISAU) (SecurityAuditMail@ftb.ca.gov) of any unauthorized or suspected unauthorized accesses, uses, and/or disclosures (incidents). For purposes of this section, immediately is defined as within 24 hours of the discovery of the breach. The notification must describe the incident in detail and identify responsible personnel (name, title, and contact information). The agency and its vendor will provide to FTB the information necessary to comply with the incident reporting requirements provided in Civil Code Section 1798.29 and SAM Chapter 5300 and SAM Section 20080 to facilitate or fulfill the required reporting to the taxpayers, debtors, or state oversight agencies.

- Information security

-

Information security is defined as the preservation of the confidentiality, integrity, and availability of information. A secure environment is required to protect the confidential information obtained by the participating agency or its vendor pursuant to the IIC Program and this agreement. The participating agency and its vendor will store data and information so that it is physically secure from unauthorized access. The records received will be securely maintained and accessible only by the employees assigned to the IIC Program who are committed to protect the data and information from unauthorized access, use, or disclosure. All FTB electronic data must be encrypted when in transit using Federal Information Processing Standards 140-2 approved encryption technology and, be password protected, and secure at all times when in storage. Confidential information and data obtained from FTB must be secured in accordance with the State Administrative Manual, including Chapters 5100 (EDP Standards) and 5300 (Information Security), National Institute of Standards and Technology (NIST) Special Publication 800-53 (moderate), and additional security requirements provided by FTB. FTB may require that a Security Questionnaire (FTB 5603) be completed by the participating agency receiving confidential data from FTB and its vendor and kept on file with FTB’s Information Security Oversight Section.

- Destruction of records

-

All records received by the participating agency and its vendor from FTB, and any database created, copies made, or files attributed to the records received, shall be returned or destroyed upon completion of the business purpose for which it was obtained. The records shall be destroyed in a manner to be deemed unusable or unreadable, and to the extent that an individual record can no longer be reasonably ascertained.

- Safeguard review

-

FTB retains the right to conduct on-site safeguard reviews of both the participating agency and its vendor’s use of FTB data and information and security controls established. FTB will provide a minimum of seven (7) days' notice of a safeguard review being conducted by FTB staff.

- Cloud computing environment

-

A cloud computing environment cannot be used to receive, transmit, store, or process FTB’s confidential data and information without prior written approval from FTB’s Chief Security Officer.

- Dispute resolution

-

In the event of a dispute, the participating agency shall file a “Notice of Dispute” with the Chief Financial Officer of the Franchise Tax Board within ten (10) days of discovery of the problem. Within ten (10) days the Chief Financial Officer, or their designee, shall meet with the participating agency’s designee and its vendor’s designee for purposes of resolving the dispute. The decision of the Chief Financial Officer shall be final.

- Denial of access to vendor

-

FTB reserves the right to deny access to the agency’s vendor immediately in the event FTB determines, in its sole discretion, that vendor is not in compliance with, or at any time in the past has not complied with, any terms or conditions of this Interagency Intercept Collection Program – Special Terms and Conditions, or that the results of an FTB safeguard review of the vendor’s use of FTB data and information or security controls established are not satisfactory to FTB. FTB will provide written notice to agency upon termination of the vendor’s access. Unless terminated earlier, the vendor’s access shall be terminated automatically upon termination of this agreement, without further notice to vendor. The vendor’s obligations to protect the confidentiality of FTB’s data and information, including the destruction of records, shall survive the termination of the vendor’s access to FTB data and information under this agreement, the termination of this agreement, or the termination of either the agency's or its vendor's participation in the IIC Program.

- Vendor and potential subcontractors

-

With the sole exception of the terms and conditions for the vendor to be permitted conditional access to FTB’s data and information on behalf of the participating agency, including the vendor’s obligations to protect the confidentiality of FTB’s data and information, nothing contained in FTB 2645 or otherwise shall create any contractual relationship between FTB and the participating agency’s vendor, or any other vendors or subcontractors of the participating agency or vendor, and no subcontract shall relieve the participating agency or vendor of their responsibilities and obligations hereunder. The agency agrees to be as fully responsible to FTB for the acts and omissions of its vendor, other vendors and subcontractors, and of persons either directly or indirectly employed by any of them, as it is for the acts and omissions of persons directly employed by the agency. Without relieving the agency of its foregoing responsibilities to FTB, the agency’s vendor also agrees to be as fully responsible to FTB for the acts and omissions of its vendors or subcontractors, and of persons either directly or indirectly employed by any of them, as it is for the acts and omissions of persons directly employed by the vendor. The agency and its vendor shall be solely responsible for the payment of their vendors and subcontractors, and FTB shall have no obligation to pay or to verify the payment of any monies to any vendor or subcontractor.

- Survival of Obligation to Protect Data

-

The participating agency’s or its vendor’s obligation to protect the data and information received from FTB shall survive the expiration or termination of this Agreement, or the termination of the agency’s or its vendor’s participation in the IIC Program. In the event FTB continues to provide any data or information to the participating agency or its vendor after the expiration or termination of this Agreement, the participating agency and its vendor agrees to continue to protect all such data and information received in accordance with the provisions of the Interagency Intercept Collection Program Special Terms and Conditions, and all applicable state and federal laws.

All agencies must adhere to the Interagency Intercept Collection Program Special Terms and Conditions and maintain FTB 7904 for their records.

Chapter 5 — Participation Overview

Agencies may participate in the IIC Program at any time. However, since FTB processes most refunds during the first four months of the calendar year, the participating agency will benefit most by following the, IIC Program Yearly Timeline.

IIC Program Yearly Timeline

If you’re a new participant: By the beginning of September, you must submit FTB 2282 PC, Request to Participate to SCO and submit FTB 2280 PC, Intent to Participate and Agency Certification to FTB. Once SCO approves participation and sends authorization to FTB, we will assign an agency code and send a welcome letter to the agency.

If you’re a returning participant: By the beginning of October, you must submit FTB 2280 PC, Intent to Participate, to FTB.

Next Steps

- By the beginning of October, agency sends pre-intercept notice to taxpayers.

- Intent to Participate/Agency Certification

- By December 1, agency submits the annual accounts to FTB.

- By mid-December, FTB no longer accepts modifications for prior year accounts.

- By the end of December, FTB purges all prior year accounts.

- By the first week in January, FTB loads all annual accounts.

- By the middle of February, FTB sends agency their accepted and rejected annual accounts

- In May, SCO sends billing statements for services to agency.

- Remit payment to SCO by the due date on the billing statement.

- By the beginning of September, FTB 2645, Interagency Collection Program Participation Guide, is available online.

Additional Information

- Weekly – Transaction Error Reports and Weekly Detail Reports are produced and sent to agencies.

- Monthly – FTB disburses payments to agencies through the State Controller.

Anytime during the year, agencies may update or correct agency contact information (ex: name, address, phone, fax, etc. ) Anytime during the year, agencies can add, change, or delete account information.

The participating agency maintains ownership of their debts and is responsible for the validity of the debt and the information submitted to the IIC Program. Agencies send their debts to FTB through SWIFT on a daily or weekly basis. (Refer to Chapter 6 for information on submitting debts through SWIFT.) FTB only accepts one file per day for each agency code. We compare the debtor SSN and name elements provided in the agency’s record with the SSN and name elements in our system. We require a match on both SSN and name to intercept a payment.

Request to participate

To qualify for the IIC Program or change the type of debts an agency wishes to collect, the agency's executive officer or director signs and submits FTB 2282 PC, Initial Request to Participate, to SCO. For a copy of the form, go to ftb.ca.gov and search for 2282. Only new agencies or agencies changing the type of debts to be collected must submit this form to SCO. After SCO approves the request to participate, they will mail an approval notice to FTB and copy the requesting agency.

Intent to participate/agency certification

An agency may submit FTB 2280 PC, Intent to Participate/Agency Certification, to FTB while awaiting approval from SCO. For a copy of the form, go to ftb.ca.gov and search for 2280.

To participate in the IIC Program, the agency’s executive officer or director signs and submits an FTB 2280 PC annually. For new agencies: once FTB receives approval for your participation from SCO and completed FTB 2280 PC, the IIC Program will send the agency a welcome letter with an assigned two-digit agency code. Failure to submit FTB 2280 by October 1 may result in suspension of intercepts until the requirement is met.

Confidentiality statement

Each agency must submit FTB 7904, Vendor/Contractor Confidentiality Statement. Every person in the participating agency’s office and third-party vendors who may have access to the confidential or sensitive data, is required to read, sign, and follow the terms of FTB 7904. FTB 7904 must be updated whenever new staff or vendors are given access to FTB data. Participating agencies must maintain the Confidentiality Statement. FTB may request it at any time.

Pre-intercept notice

Participating agencies required to send debtors a Pre-Intercept Notice that contains specific due process language. Refer to sample FTB 2288, Pre-Intercept Notice Instructions. The notice should be sent via U.S. mail, unless the debtor previously elected to receive electronic correspondence. The notice must:

- Specify the GC Sections that authorize the agency to submit debts for intercept.

- Allow debtors 30 days to resolve or dispute the debts, before debts are submitted to FTB.

- Provide agency’s contact information where the debtor can dispute the liability.

The copy of the Pre-Intercept Notice needs to either be a blank template with no debtor information or if using an existing notice all identifiable information must be redacted: Name, Address, and Account number. If a Pre-Intercept Notice is received with debtor information it will be returned.

Effective and cooperative communication

It is critical FTB Intercept Program liaisons listed on FTB 2280 PC effectively communicate with debtors and FTB staff on account information, resolution of issues, and ensuring customer needs are met. FTB requires agencies to respond to their debtor within 48 hours when contacted by FTB staff to ensure issues are resolved and customer needs are met. Failure to cooperate in effective communication and account resolution may result in a suspension of intercepts for the participating agency.

Secure Email

Our Secure Email Service enables us to encrypt confidential state tax information and other private or sensitive FTB business emails before sending to customers outside our department. FTB staff will use secure, encrypted email for debtor assistance requests. For additional information and help, go to ftb.ca.gov and search for secure mail.

Annual debtor accounts

Submit annual debtor accounts (annual load file) by December 1. Refer to the File Exchange Guidelines section for more information about how to submit accounts. Once an annual load is submitted, changes are unable to be made until the second week of January. Between December and February, the IIC Program completes the following actions during the annual process:

- Purge all debts the last week in December.

- Process annual debtor accounts for the upcoming calendar year the first week in January.

- Send a listing of accounts received and rejected in February.

If a new agency was approved after November 1, then refer to the modified debtor account method for your first submission of records. Agencies can send first submission the second week of January.

- Contact the IIC Program if you would like to receive a conversion chart with instructions on formatting accounts.

Modified debtor accounts

Submit modified debtor accounts to update the balance on an account at any time during the process year. The middle of December is the deadline to submit modified accounts for the current process year before annual processing for the upcoming process year. Agencies are not required to update the balance for intercepts during the year; however, agencies should modify the balance for other payments outside of intercepts or deletions to avoid over collection. Refer to the File Exchange Guidelines section for more information about how to submit accounts.

Reports

The IIC Program provides the following reports:

- Weekly detailed report of offset activity for each payment type (one each for personal income tax refunds, lottery winnings, and unclaimed property claim payments). The reports include the name of the debtor, intercept amount, intercept date, and your debtor’s account number. This report is available in the agency's SWIFT folder.

- Daily or weekly error report of rejected accounts including the debtor’s account information submitted to FTB and the reason the account was rejected. This report is available in the agency’s SWIFT folder after the file is processed. If there are questions about a rejected account, refer to the Rejected Accounts section.

- Monthly reversal report of erroneous intercepts including debtor’s account information and amount of reversal. The report is only provided in an encrypted email.

The IIC Program only sends these reports if there is intercept, reject, or reversal activity.

Disbursements

SCO disburses intercept payments to the agency each month through a funds transfer or warrant. Only state agencies are eligible for a funds transfer. If the agency is unable to reconcile the disbursement amount with weekly offset reports, call the IIC Program agency line at 916-845-5344.

Reversals

Occasionally, the IIC Program intercept funds in error due to misapplied payments caused by a credit on the wrong account. If it is determined the agency received funds in error, the agency’s monthly payment amount will be reduced by the reversal amount. The reversal will be done in the month the error is identified. The IIC Program will send a monthly Intercept Reversal Notice advising of the reversals including the following information:

- Agency name

- Agency code

- Individual’s name

- SSN

- Dollar amount of intercept

- Date of intercept

- Account number (if given)

- Year

The agency can then adjust records and intercept requested amount(s) to reflect the change. If the reversal amount is higher than the current intercept payment amount, the IIC Program will continue to reduce the amount of intercept payments until the reversal amount is satisfied. However, if after six months the IIC Program is unable to make an adjustment for the full reversal amount, the agency will be sent a letter requesting payment remittal.

Chapter 6 — Exchange Files through Secure Web Internet File Transfer (SWIFT)

- SWIFT Overview

- SWIFT Process

- Benefits

- Registration

- Create Files

- Record Layouts

- File Exchange Guidelines (fromFTB)

- Annual Debtor Accounts Accepted & Rejected

- Modified Debtor Accounts Rejected

- Weekly Offset Detail Reports

SWIFT overview

The Secure Web Internet File Transfer (SWIFT) is the only permitted method for file exchange. Contact the IIC Program agency line at 916-845-5344 to request an Excel spreadsheet template to assist converting paper requests to a SWIFT format.

The following represents the IIC Program files exchanged:

| File | Type | Frequency |

|---|---|---|

| Annual Debtor Accounts (annual load) | ToFTB | Annually |

| Annual Debtor Accounts Accepted & Rejected (FTB Response File) | FromFTB | Annually |

| Modified Debtor Accounts | ToFTB | As needed |

| Modified Debtor Account Rejected | FromFTB | As processed |

| Weekly Offset Detail Report Personal Income Tax | FromFTB | Weekly |

| Weekly Offset Detail Report Lottery | FromFTB | Weekly |

| Weekly Offset Detail Report Unclaimed Property | FromFTB | Weekly |

If the participating agency has multiple agency codes, the agency must separately identify each agency code and its accompanying accounts. The IIC Program requests a separate SWIFT file folder and transmittal for each agency code.

SWIFT process

All external customers use SWIFT to submit confidential information through the Internet. Agencies must submit debtor accounts with this method. To obtain a user guide for SWIFT go to ftb.ca.gov, and search for swift. This part of the guide explains the following about SWIFT:

- Benefits

- Registration

- Creating Files

Benefits

SWIFT allows:

- FTB to process the file the same day if it is received between the hours of 8 a.m. and 5 p.m., weekdays. If a file is received after 5 p.m., it is processed the next business day.

- Participating agencies to update files daily.

- Participating agencies to receive an email notification when FTB has received a file.

Registration

To register for SWIFT:

- Contact IIC Program agency line at 916-845-5344 to obtain your agency code.

- Establish contact(s) for file transfer notification. If an agency’s contact is more than one person, obtain a group email ID.

- Go to swift.ftb.ca.gov to log in. Use the assigned SWIFT email ID.

- Once registered, SWIFT will send the agency a temporary password.

- The temporary password must be changed once it is received. SWIFT requires an account password to be updated once a year. SWIFT will not prompt the account before the password expires.

Create files

To create SWIFT files:

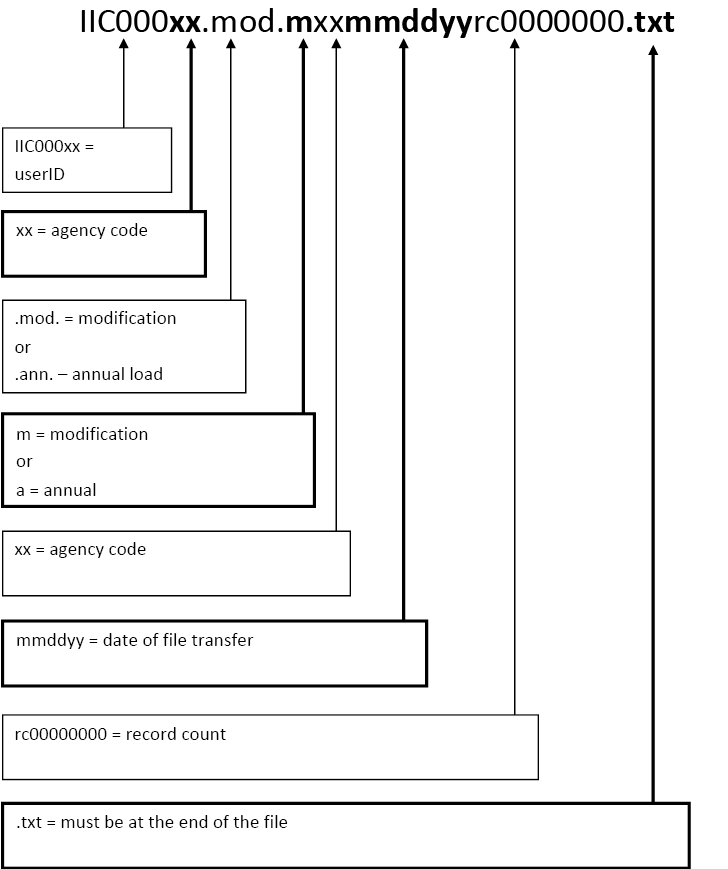

- Create a text file using the record layouts for Annual or Modification Listing of Accounts. Save the file in a text format with the following file name structure. This can be done by writing accounts in the Notepad program in Windows.

Example:

IIC000ba.mod.mba050424rc0001020.txt

Modification Listing for Agency Code BA on 05/04/24 of 1,020 records - Use the SWIFT email ID to log in. Agencies must select ASCII when submitting their annual/mod files. In the upper right corner in SWIFT under Welcome, use the drop-down box, and select Preferences. Select ASCII once the pop-up window appears in transfer mode. Copy the file into the appropriate folder (ToFTB Annual Files or ToFTB Modification Files).

For assistance with formatting files, call the IIC Program agency line at 916-845-5344.

Record layouts

Annual and Modification Account Files: 91 characters

The following charts reflects the record layout for both Annual Load and Modification files, including field length and character position for text files.

** NOTE: x indicates a space for visual example.| Field Name | Description | Instructions | Field Length | Character Position |

|---|---|---|---|---|

| Agency Code | Assigned two-digit code all CAPS. | Left justified, use blank spaces filled on the right side to fill field. Example: ACxxx |

5 | 1-5 |

| Debtor SSN | Debtor’s nine-digit identification number | Example: 123456789 | 9 | 6-14 |

| Debtor Last Name | Debtor’s full last name using all CAPS. If last name has less than 24 letters, add space(s) at end of name. | Left justified, use blank spaces filled on the right side to fill field. Example: SMITHxxxxxxxxxxxxxxxxxxx |

24 | 15-38 |

| Debtor Suffix | Debtor’s full suffix using all CAPS. | Left justified, use blank spaces filled on the right side to fill field. Example: JRx *If no suffix, use 3 spaces Example: xxx |

3 | 39-41 |

| Debtor First Name | Debtor’s full first name using all CAPS. If first name has less than 20 letters, add spaces at end of name. | Left justified, use blank spaces filled on the right side to fill field. Example: BOBxxxxxxxxxxxxxxxxx |

20 | 42-61 |

| Debtor Middle Initial | Debtor’s middle initial using CAPS. | Left justified, use blank spaces filled on the right side to fill field. *If no middle initial use 1 space Example: x |

1 | 62 |

| Debt Amount | The numeric amount agency is requesting to intercept. | Right justified, numeric, zero filled on left. Example: $50.16 would be 000005016 |

9 | 63-71 |

| Account/Case Number | The alphanumeric value participating agency assigns to accounts to differentiate one from another | Left justified, use blank spaces filled on the right side to fill field. Example: AB222222222xxxxxxxxx |

20 | 72-91 |

| Total Field Length | 91 | |||

File exchange guidelines (from FTB)

Annual Debtor Accounts

When agencies send annual debtor accounts during year-end processing, IIC will returns a file of accounts that were accepted and rejected.

IIC will include the following information in this file:

- Agency code

- Debtor’s SSN

- Debtor’s name

- Offset requested amount

- Agency’s debtor account number

- Error message (rejected accounts only)

Annual Debtor Accounts Response File: 151 Characters

| Field Name | Field Type | Field Length | Field Start Position | Instruction |

|---|---|---|---|---|

| Agency Code | Alpha Numeric | 5 | 1-5 | |

| Debtor SSN | Numeric | 9 | 6-14 | |

| Debtor Last Name | Alpha | 24 | 15-38 | Left justified |

| Debtor Suffix | Alpha | 3 | 39-41 | Left justified |

| Debtor First Name | Alpha | 20 | 42-61 | Left justified |

| Debtor Middle Initial | Alpha | 1 | 62 | |

| Debtor Amount | Numeric | 9 | 63-71 | Right justified |

| Agency Account Number | Alpha Numeric | 20 | 72-91 | Left justified |

| Error message | Alpha | 60 | 92-151 | Left justified |

Modified Debtor Accounts Response File

When agencies send modification accounts throughout the year, IIC returns a file of accounts that were rejected.

IIC will include the following information in this file:

- Agency code

- Debtor SSN

- Debtor name Control

- Blank field (previously used for Add, Change, Delete designation)

- Offset amount

- Agency account number

- Error message

- Date

Modified Debtor Accounts Response File: 100 characters

| Field Name | Field Type | Field Length | Field Start Position | Instruction |

|---|---|---|---|---|

| Agency Code | Alpha Numeric | 2 | 1-2 | |

| Debtor SSN | Numeric | 9 | 3-11 | |

| Debtor Name Control | Alpha | 4 | 12-15 | Left justified, space-filled |

| Blank field (previously used for Add, Change, Delete designation) | Alpha | 1 | 16 | This field is a placeholder and will always be a space (blank). |

| Offset Amount Defined decimal |

Alpha Numeric | 10 | 17-26 | Example: 116.34 If debt is zero, will appear as 0.00, Right justified. |

| Agency Account Number | Alpha Numeric | 20 | 27-46 | Left justified |

| Error Message | Alpha | 44 | 47-90 | Left justified |

| Date | Alpha Numeric | 10 | 91-100 | MM/DD/CC/YY |

Weekly Offset Detail Reports

These files provide the successful intercept information necessary to post payments to the debtor accounts and reconcile receivables. IIC provides separate reports for each payment type: personal income tax, lottery, and unclaimed property. If there is not any intercept activity, IIC will not generate a report.

The following information is included on this report/file:

- Agency code

- Debtor’s SSN

- Debtor's name

- Intercept amount

- Agency's debtor account number

Rejected accounts

If accounts are rejected, IIC will send the agency a Rejected Account Report, including the reason the account was rejected. Refer to the detailed descriptions of error messages as follows:

| Error Message | Message description |

|---|---|

| Requested change or add was less than $10 |

|

| SSAN must contain 9 numbers | If you're receiving this error it means the SSN doesn't meet the character requirements. Refer to record layout. |

| Your agency code was not found on account | If you're receiving this error it means the agency ID does not exist. Agency codes are case sensitive. Refer to record layout. |

| Duplicate data on tape for SSAN | If you are receiving this error it means there are duplicate account transactions for the same debtor. Combine dollar amount of all transactions into one and re-submit. Refer to chapter 2: debt criteria. |

| Requested offset amount must be numeric | Offset Amount must be right justified, numeric only, and zero filled on left. Refer to record layout for example. |

| Multiple SSAN matches found; cannot offset | Multiple individuals in FTB Systems use this account’s SSN. IIC is unable to accept a resubmission for this account. |

| County Code Submitted is not all Numeric | Resubmit County Code with numbers only. Child Support Agency Codes must have the first 3 positions of the agency account number as numeric. This identifies the county. |

| Last name must be in alpha characters | If you’re receiving this error refer to the name you submitted for the record. Names cannot be blank and must be in all CAPS. Refer to record layout. |

| Unavailable for Matching | Currently, FTB data is unavailable for matching. |

| No Match | If you are participating in ID Lookup and submitted a modification record this error indicates the agency account number does not match FTB records. |

Chapter 7 — Submit Accounts without an SSN (ID Lookup)

Overview

Qualifying agencies may submit debts without an SSN using ID Lookup process. If an agency would like to participate in ID Lookup, email requests to iicgroup@ftb.ca.gov. Include the following information:

- Agency name.

- Type of debts.

- Approximate volume of debts participating agency plans to submit without an SSN.

Participation in ID Lookup is limited.

Chapter 8 — Contact Information

Use the following information to contact FTB and SCO. List the agency name, agency code, and the words Interagency Intercept Collection Program on all submissions and correspondence sent to FTB.

FTB only works with agencies. Debtors and third parties must contact the agency directly.

- FTB IIC Program

- State Controller’s Office Contacts

FTB IIC program staff

IIC staff can answer program questions or provide services and support, such as:

- Assist agency staff with answering debtor questions.

- Provide copies of missing reports.

- Assist in reconciling weekly reports to monthly fund transfer.

- Assist agency with registering for SWIFT.

- Answer billing questions.

- Address

- State of California

Interagency Intercept Collections MS A116

Franchise Tax Board

PO Box 2966

Rancho Cordova CA 95741-2966 - Phone

- 916-845-5344

- Fax

- 916-843-2460

- iicgroup@ftb.ca.gov

DO NOT SEND confidential account information through email

State Controller’s office contacts

Agencies contact SCO about questions pertaining to their involvement in the IIC Program.

- Address

- Office of the State Controller

Local Government Programs and Services Division

Tax Administration Section

Attn: Intercept Coordinator

PO Box 942850

Sacramento CA 94250-5880 - Phone

- 916-322-0608

- intercept@sco.ca.gov

Chapter 9 — List of Forms

Use the following forms to participate in the IIC Program. Go to ftb.ca.gov and search for intercept to get the most recent version.

| Form Name | Intended Use | Form Number |

|---|---|---|

| Initial Request to Participate | New agencies or debt type changes. | FTB 2282 PC |

| Intent to Participate and Agency Certification | New agencies and returning agencies (annually). | FTB 2280 PC |

| Pre-Intercept Notice Sample | Use as model for your intercept notice. | FTB 2288 |

| Intent to Participate – Identification Search | New and returning agencies for ID Lookup. | FTB 2280A PC |

| Request for Social Security Number Search | County and city tax officials can use to request SSNs. | FTB 2284 PC *Not available online. Contact the IIC Program staff. |

| Interagency Intercept Collection (IIC) Program Yearly Timeline | Annual intercept process. | FTB 2646 |

| Vendor/Contractor Confidentiality Statement | All agencies must maintain this privacy requirement. | FTB 7904 |