Audit careers

You add value. Join our team and make a difference.

FTB Auditor Series job opportunities

Start your career with FTB! We have two entry-level positions available in Audit and Taxation. Check out the minimum qualifications to see which classification you qualify for:

| Tax auditor | Program specialist |

|---|---|

| Minimum qualifications | Minimum qualifications |

| Self-assessment exam | Self-assessment exam (Open January & June) |

| Open job opportunities | Open job opportunities |

If you dont see a job opening available now, please check back in soon.

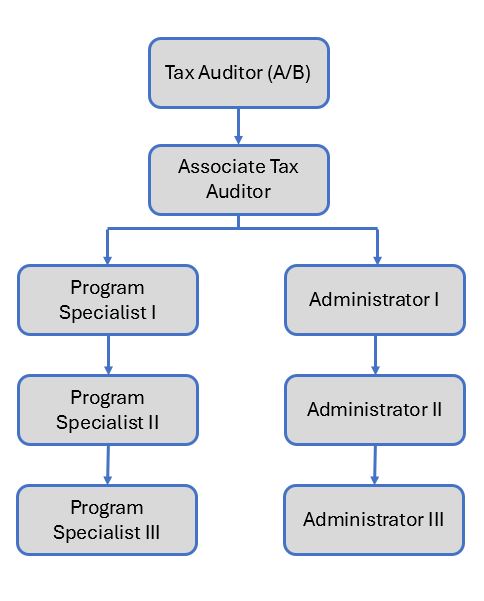

Auditor career paths

Office locations

- California: Sacramento, Oakland, San Francisco, San Jose, Van Nuys, Los Angeles, West Covina, Santa Ana, San Diego

- Out of State: Houston, Chicago, and New York

How to apply

- Create a CalCareers account.

- Complete Tax auditor self-assessment or Program specialist self-assessment.

- Apply for a job vacancy posted on CalCareers.

How our process works

Here is an approximate timetime for a typical job posting:

| Application step | Timeframe |

|---|---|

| Job is posted and applications accepted | 10-30 days |

| Applications go through screening process | 10 days |

| Interview scheduling and process | 14 days |

| 2nd interview scheduling and process | 14 days |

| Reference checks | 14 days |

| Conditional offers and background check | 30 days |

| Final job offer | Varies by job posting |

Why work for the state of California?

Some of the many great reasons to work for the state include:

- Stable and meaningful work with work-life balance.

- Telework opportunities and flexible work schedules in all programs.

- Flexible future: Build your career, change career paths, and more.

- Health, dental and vision care: Many plans to choose from.

- Retirement plan, 401K and 457(b) savings plans, and more.

- Paid leave: vacation, sick leave, holidays, and more.

For more information read through the Careers with Franchise Tax Board brochure.

Contact us for more information

Reach out to our Audit recruiters.

- Audit Recruiter

- Guest Book

- Audit Careers guest book

- Audit Program Specialist guest book